haven't filed taxes in 5 years canada

But if you filed your tax return 60 days after the due date or the. Get in contact with an accountant who specializes in taxes explain the situation and get your paperwork in.

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

You are not the only person to have gone years without submitting.

. Get A Free Consultation. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. If you havent filed your taxes with the cra in many years or if you havent paid debt.

For each return that is more than 60 days past its due date they will assess a 135 minimum. What Should I Do Now. If you owe money to the CRA you will endure a late filing penalty of 5 of your unpaid taxes plus 1 a month for 12 months from the filing due date.

Havent filed taxes in 10 years Canada Close. Failing to pay your taxes is not a crime but failing to file your tax returns is because its considered tax evasion. No matter how long its been get started.

This penalty is usually 5 of the unpaid taxes. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year. Havent Filed Taxes in 5 Years If You Are Due a Refund.

No Tax Knowledge Needed. Believe it or not millions of. Answer 1 of 24.

Failure to file a tax return. You could owe a lot of money and not be able to afford to repay it you might have forgotten to pay. Our Tax Experts Are Here To Help.

However you can still claim your refund for any returns. There could be many reasons why a person wouldnt have paid their taxes for several years. If your taxes are simple it shouldnt take too long to do.

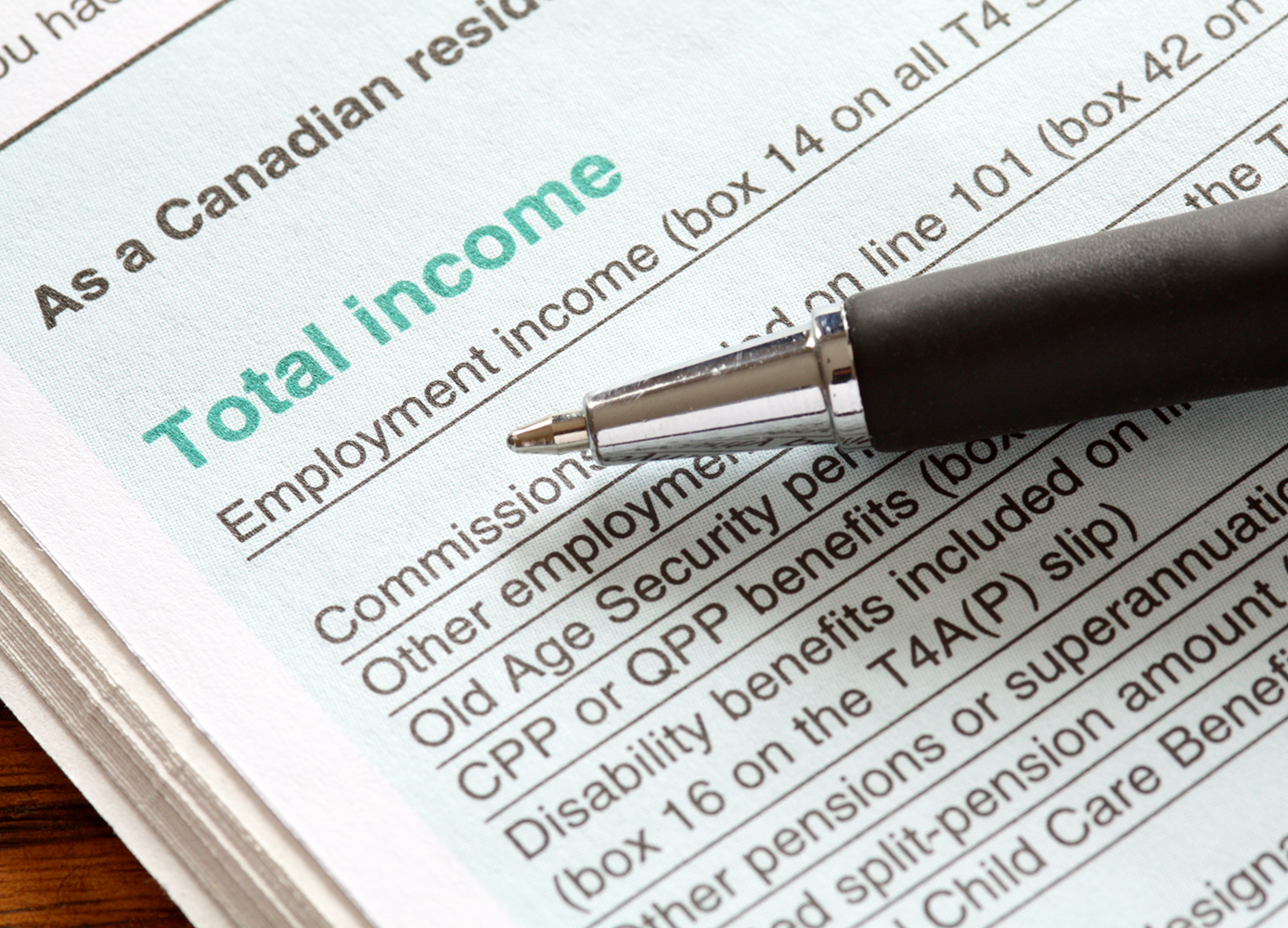

For more recent returns you can file using government. The CRA will file the income tax return on time if you owe money and file your return too late on paper for a. Its too late to claim your refund for returns due more than three years ago.

Ad Havent Filed Your Taxes In Years. What Happens If You HavenT Filed Your Taxes In 5 Years Canada. And the penalties for tax evasion are harsh.

Dont Need To Pay Extra Commission. Filing your taxes in Canada is a straightforward process that needs to be done every year. Moshe Klein The AFFORDABLE Accounting Firm.

Ad Havent Filed Your Taxes In Years. I havent filed taxes for over 5 years and cant do it online and im scared to ask the government what to do. Dont Need To Pay Extra Commission.

The longer you wait to file your taxes the more penalties you will owe and the likelihood of the CRA seeing your avoidance as tax. If you owed taxes for the years you havent filed the IRS has not forgotten. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your.

Posted by 3 years ago. Get A Free Consultation. As a result of owing tax and failing to file your income tax return by time the CRA will issue you a late filing.

The penalty charge will not exceed 25 of your total taxes owed. Capture Your W-2 In A Snap And File Your Tax Returns With Ease. The CRA lets you file taxes as far back as 10 years but youll need to submit paper returns for anything prior to 2017.

What Happens If You HavenT Filed Your Taxes In 5 Years Canada. You may also face late filing penalties. Havent filed taxes in 10 years Canada I dont know how this happened but I let it all get so overwhelming and the.

Our Tax Experts Are Here To Help. I Havent Filed Tax Returns in Five Years.

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

What S The Simplest Explanation Of A Canadian Tax Return Quora

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

How Many Years Can I Go Without Filing Taxes Canada Ictsd Org

Is There A Penalty For Filing Taxes Late If You Don T Owe Late Tax Filing Liu Associates Edmonton Calgary

Can You Go To Jail For Not Paying Taxes Canada Ictsd Org

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Can I Go To Jail For Not Filing Taxes In Canada Cubetoronto Com

Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Income Tax Business Tax Finance Bloggers

What If I Can T Pay My Taxes In Canada Loans Canada

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Don T Wait Any Longer To File Your Taxes Good Times

How Far Back Can You File Taxes Canada Ictsd Org

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law